The CAA Story

In 2015, CAA Insurance began a journey to seek out and partner with independent Brokers that provide quality service to both CAA Member and customers.

About Us

We are a private mid-size Property and Casualty Insurance Market with multiple offerings of Insurance products and services.

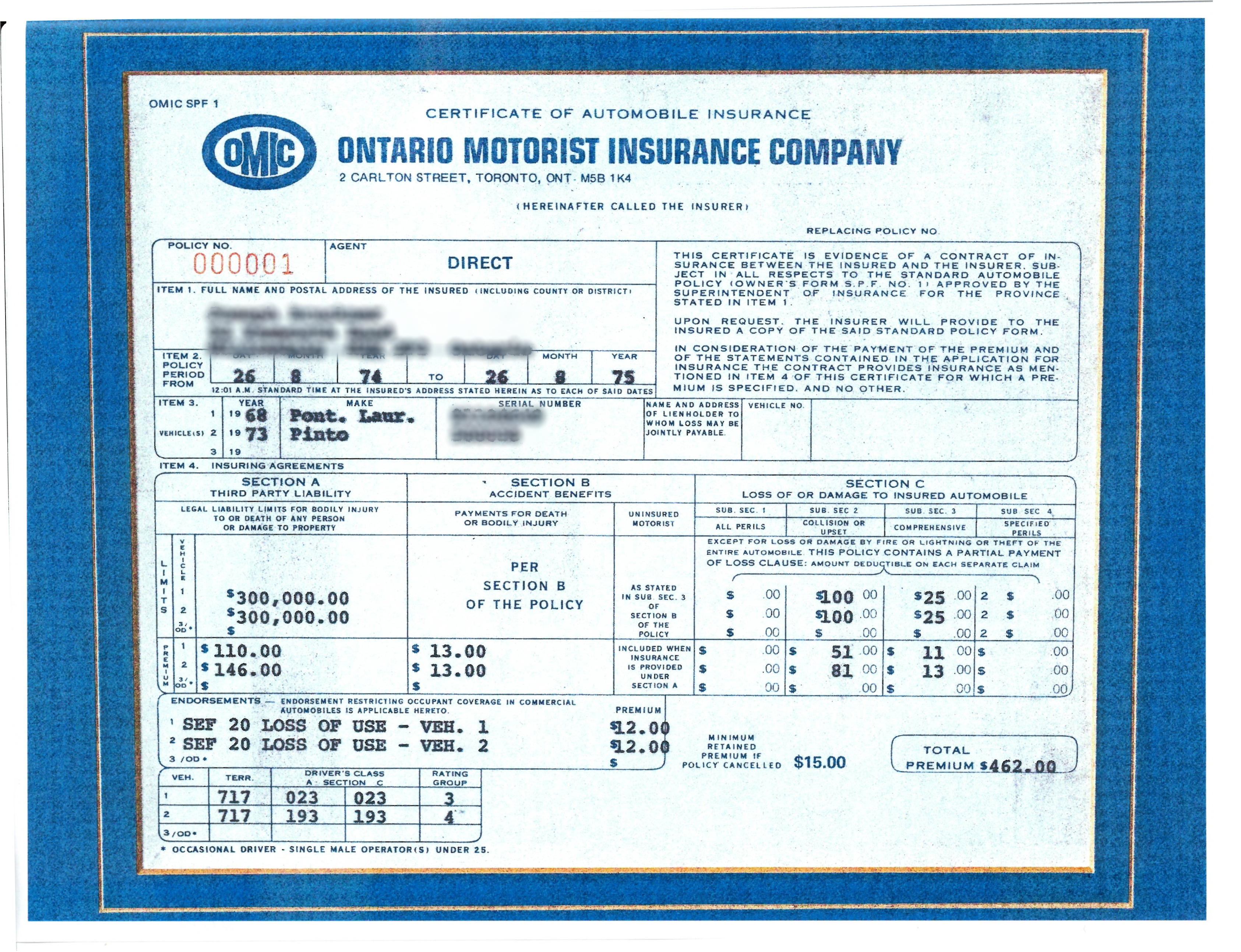

Established in 1974, CAA Insurance Company was named Ontario Motorist Insurance Company (OMIC), and was one of the first major Canadian auto insurance companies in Ontario. In August 1974 the first policy was written – total premium for the 2-vehicle policy was $462.00.

In 2015, CAA Insurance began a journey to seek out and partner with independent Brokers that provide quality service to both CAA Member and customers. One idea in mind is paramount, we want to provide all CAA Members access to the same product at the same price regardless of how you wish to purchase your insurance.

Why did we enter the Broker market?

Over the years, we have learned what brokers already know – customers like choice and they also like brokers. People choose their method of buying insurance before choosing their supplier. According to the IBAO 2016 Consumer Survey, over 50% of those surveyed in Ontario prefer to buy their home and auto insurance through a broker and in areas like Manitoba with government insurance it’s as high as 80%. It’s no different with CAA Members. When we consider the demographic of our insurance customers, we think that number could be even higher. CAA Insurance was created to support our Members. We think the best way to serve them is by giving them the ability to purchase through the method they already know and trust.

We are very committed to the principle of offering the same product at the same price regardless of channel. If we are going to offer our insurance under one brand, it is critical that what your customer receives is exactly the same as what they could get through their club. We’ve done the detailed analysis and we know that both our broker channel and CAA Club partnerships are on par from a profitability perspective. But even more importantly, it’s just the right thing to do. We are here for Canadians who value CAA Insurance and the Broker and CAA Clubs that serve them.

Who Are We?

CAA is an incredibly strong and trusted brand that has a 100-year relationship with Canadians. We want to give the brokers we work with the unique competitive advantage that comes with providing insurance from a trusted Canadian brand they already know. In addition, our brand strength is built on safety and never letting our Members down. The CAA Insurance proposition is built on these same principles.

At the core of our organization are our people. Our frontline Insurance Associates and our Insurance Broker partners are licensed professionals who are well trained in the technical aspects of insurance as well as how to wow our members and your customers.

Our goal is “To have every CAA Member choose a CAA insurance policy in their channel preference”.